We are seeing more new-start co-operatives set-up as LLP's and even some conversions of existing co-operatives. software.coop has written up their personal experience of setting up a Limited Liability Partnership and some of the practical things you should know. If you want to know more or interested in setting one up please contact Co-operativesUK. We can put you in touch with existing LLP's like software.coop or help regsiter your LLP, with the co-operative values and principles in mind.

We are seeing more new-start co-operatives set-up as LLP's and even some conversions of existing co-operatives. software.coop has written up their personal experience of setting up a Limited Liability Partnership and some of the practical things you should know. If you want to know more or interested in setting one up please contact Co-operativesUK. We can put you in touch with existing LLP's like software.coop or help regsiter your LLP, with the co-operative values and principles in mind.Software.coop is a tech worker co-op centred on web and GNU/Linux development and maintenance, with particular interests in library management systems, email services and Django, Drupal and Wordpress web applications.

As well as being strongly in favour of Free and Open Source Software (FOSS) because of its importance for cooperative values, we're also fairly unusual in being a Limited Liability Partnership (LLP) instead of a Ltd company.

The co-op currently has four members and no employees. Our headquarters are now in Somerset, but no two members are currently in the same region, while we work for clients around the world. That wasn't intentional, but it seems to work.

Software.coop became a CooperativesUK member in 2007 and has recently applied to join Cooperatives-NW. Member MJ Ray currently represents tech/worker co-op views on the board of Cooperatives-SW and is struggling to get involved with the North Somerset Partnership and West of England Partnership.

"The essential feature of an LLP is that it combines the organisational flexibility and tax status of a partnership with limited liability for its members." - Explanatory Notes to the Limited Liability Partnerships Act 2000

We chose LLP as the corporate form because it appeared to have low start-up costs and low administration costs. Also, we took the enthusiasm of professional services businesses like accountants for the LLP as a good sign. Finally, because we didn't have to file particular rules with the registrar of companies, we could improve them if we found any flaw or mistake in them, without much bureaucratic process. We actually used this feature when we replaced our original rules with a modified set that made it more obviously cooperative in 2005.

Pros and Cons

The main benefits:

- Lower overheads, although I feel you need to be clear with all partners from the outset that the LLP will only address partnership tax affairs and not all members' personal tax returns;

- it is an "inherently cooperative model"[1] and you can see this in the "Default provision" section of the Limited Liability Partnerships Regulations 2001. It implements several (but not all) of the key cooperative values: voluntary membership, economic participation, member control and autonomy;

- there was no requirement to file our rules, so we could fix initial mistakes fairly cheaply.

But there were drawbacks:

- LLPs had poor support from banks. Initially, we failed to open a bank account because banks did not recognise LLPs. This has improved since Community Interest Companies (CICs) were introduced (because they also have letters in their company numbers), but even in 2007, some banks would not accept company numbers that contained letters. I thank Norwich and Peterborough Building Society's Cambridge branch for living up to their mutual status and patiently learning about LLPs in 2002 while helping us to open an account with them.

- LLPs get fewer services from Companies House than Limited companies. While there is a helpful specialist LLP Team there, LLPs are excluded from key online services, but you have to use those online services to get discounts on filing fees. In effect, this means LLPs now pay higher filing fees than Ltd companies, although I think we don't file as many forms.

- LLPs get poor support from HMRC. Because LLPs are taxed as ordinary partnerships, we have the same limited range of software for filing tax returns as ordinary partnerships and I don't think any of them are Free and Open Source Software. So, we have completed paper tax returns for all but one year to date. In effect, this means LLPs must complete their tax returns months earlier than Ltd companies.

- LLPs are not always understood or promoted as an option by some Co-op Development Advisers and many Social Enterprise Advisers. I have been surprised by how many will tell us we cannot be a cooperative or a social enterprise because we are an LLP. In our region, Social Enterprise materials include phrases like "most Limited Liability Partnerships (LLP) are not eligible" before it even considers any rules!

- Co-operativesUK questioned our worker co-op status three times: before we joined, when we joined and once since we've joined. [edit JA: Co-operativesUK checks all members are bona-fide co-ops. As the LLP model is/was a new model, we took special interest in this case.]

- LLP co-ops seem to be generally uncommunicative about their cooperative rules and most LLP co-ops that I know are not members of any larger body. I feel that this is a consequence of the initial hostility from advisers. An LLP could lose a lot by describing how it implements cooperative principles and gain little, particularly because most seem to trade more with non-cooperatives than with other cooperatives. This leaves LLP co-ops "semi-detached" from the wider movement and fails to demonstrate the cooperative difference to them.

2amase LLP are probably the best-documented example: a group of MA Social Enterprise students who are probably more sure about their ability to assert their co-op status against hostile experts. Yet the 2006 case study of 2amase LLP (available from [1]) also reports poor support from banks and advisers.

While being asked to explain LLP co-ops so many times means that cooperative status has probably been a slight net cost for TTLLP so far, we believe in the long-term benefits. The pros are very compelling and long-term, while the drawbacks seem to be mostly short-term: banks are becoming friendlier, Companies House and HMRC should catch up eventually, which just leaves raising awareness with advisers and the wider movement.

How can we persuade them to treat LLP co-ops fairly?

The Process for Setting One Up

In essence, you find at least two partners, complete form LLP2 and send it to the Registrar of Companies with the appropriate fee (£20 as of 14/10/2009). It's generally a good idea to write a partnership agreement at the same time, but it's not actually required. If you want to be really thorough, read the first LLP Act and Regulations (they're fairly short and clear as legislation goes). The Companies House guides about LLPs are also worth reading.

However, like any incorporation, it comes with responsibilities and risks of fines for maladministration, so I feel that this is not to be taken lightly.

Practical Things - Tax, NI and so on

- Tax and NI behave as if the workers are self-employed, so each member needs to:

- register with their tax office as self-employed,

- pay self-employed National Insurance quarterly and

- complete a tax return each year that includes partnership pages.

- In addition to the personal tax returns, a Partnership Tax Return will need to be completed. It is worth getting the LLP's tax reference number from HMRC as soon as you can because of the previously-mentioned poor support for LLPs by HMRC. In seven years, I haven't had a trouble-free partnership tax return yet.

- Other than that, you'll need to send a membership return (on the anniversary of the incorporation date or previous membership return) and financial accounts to Companies House each year (within 9 months of the accounting reference date). These are usually at different times.

- [1] http://www.opencapital.net/articles.htm has copies of both "The Partnership is Dead! Long Live the Limited Liability Partnership" (Chris Cook, British Journal of General Practice, Dec 2004) and the 2amase LLP case study.

- http://www.companies-house.gov.uk/about/guidance.shtml contains the LLP guides.

- Limited Liability Partnerships Act 2000 (see the explanatory notes and check http://www.statutelaw.gov.uk for updates).

- Limited Liability Partnerships Regulations 2001 are the main implementation.

- Partnership Act 1890 in general does not apply, but may be informative.

- Article on LLP as ideal structure for open co-operative enterprises.

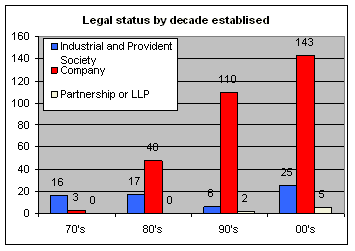

This first chart looks at all live worker co-operative records, we have 3 live co operatives dating back before the 70’s but these have not been included in this chart. IPS’s were the traditional legal form for co operatives, and most early worker co operatives registered as IPS’s. However this model was seen as cumbersome (needed 7 members to start) and quite expensive.

This first chart looks at all live worker co-operative records, we have 3 live co operatives dating back before the 70’s but these have not been included in this chart. IPS’s were the traditional legal form for co operatives, and most early worker co operatives registered as IPS’s. However this model was seen as cumbersome (needed 7 members to start) and quite expensive.